Up until recent years, buying, owning, and retaining a home for adults who were born post-1980 was out of the question. The past years of unemployment rates, foreclosures, and bad loans had deferred many millennials from thoughts of home ownership. However, with the market shift, and rates that are at all-time lows, many are ready to become first time home-buyers. In fact, 65 percent of renters ages 18-34 with an annual income of at least $50,000 have indicated their intent to buy a home has strengthened significantly within the past year

Up until recent years, buying, owning, and retaining a home for adults who were born post-1980 was out of the question. The past years of unemployment rates, foreclosures, and bad loans had deferred many millennials from thoughts of home ownership. However, with the market shift, and rates that are at all-time lows, many are ready to become first time home-buyers. In fact, 65 percent of renters ages 18-34 with an annual income of at least $50,000 have indicated their intent to buy a home has strengthened significantly within the past year

College graduates today are continuing to wise up when it comes to planning out their next chapter in life. Building a financial portfolio at a young age is becoming increasingly important. The millennials are learning from the patterns of the past and attempting to avoid them by beginning to save early.

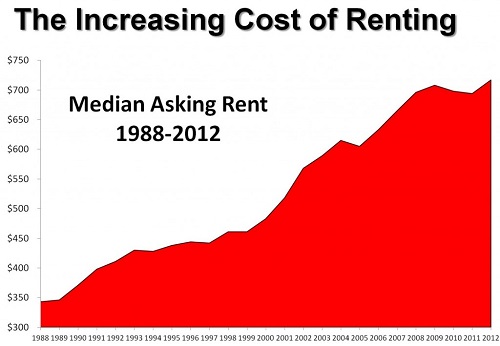

According to the National Association of Realtors, the median sales price of a home is $184,300. The mortgage payment, including principal and interest would be $661.89 per month putting at least 20% down payment at a 3.5% interest rate. In comparison, the median rent asking price is $717 per month. Now which option seems more beneficial and logical to a first time buyer?

The way I see it, instead of paying someone else to provide for you, you could provide for yourself. When weighing out the decision between renting vs. owning, you want to take a look at your current finances and get pre-qualified to determine what price point of a home you can afford. The U.S. Department of Housing and Urban Development even has a page specifically for new-home buyers which can help answer most financial questions on the subject.

The majority of millennials, 76 percent, will buy first with their spouse, and 22 percent will end up purchasing with a roommate. As a couple, the benefit of home ownership includes saving money on your monthly payment, as opposed to a rent situation, and owning a home will also help in building equity for your future.

As an individual, the benefits of owning a home include avoiding the over-payment of rent, but also the possibility of charging a roommate or two monthly rent. With the help of a decent price point, the combined rent money will cover your monthly mortgage, and maybe even place a bit extra back in your wallet.

Both scenarios will enable the homeowner to take advantage of many tax benefits. With a 30 year mortgage fix, your housing expenses will remain the same till the end of the loan. But as for renting housing expenses, the pattern is continuing to rise.

As millennials continue to look forward to a bright, successful future, home ownership seems to be at the top of their list. With the market consistently improving, now is the time, for everyone, to consider making the smart investment in home ownership.

Renting a place to live is definitely getting more expensive. Thanks for the great information!